Advisors you can Trust at a price you can Afford

Find Flat Fee advisors to help you start reaching your financial goals.

- No net worth minimums

- No confusing pricing schemes

- Professionally certified fiduciaries

.png)

Comprehensive Planning from Independent Advisors

Get advice on all aspects of your financial life, not just your investments. While big banks and institutions leave clients feeling like a number in their system, our independent advisors get to know you on a personal level. Their advice is tailored to you and your unique situation.

High Standards for Great Outcomes

Rally advisors are pre-vetted and possess the highest certifications. No matter who you choose, you can be confident you'll be in good hands

Affordable, Flat Fees with No Surprises

Our advisors only charge a flat transparent fee for their expertise. You'll know exactly what you're paying and you won't be charged more as your portfolio grows.

-

Keep More of Your Money

-

No Conflict of Interest

-

Favorable Client Terms

-

No Screening Calls

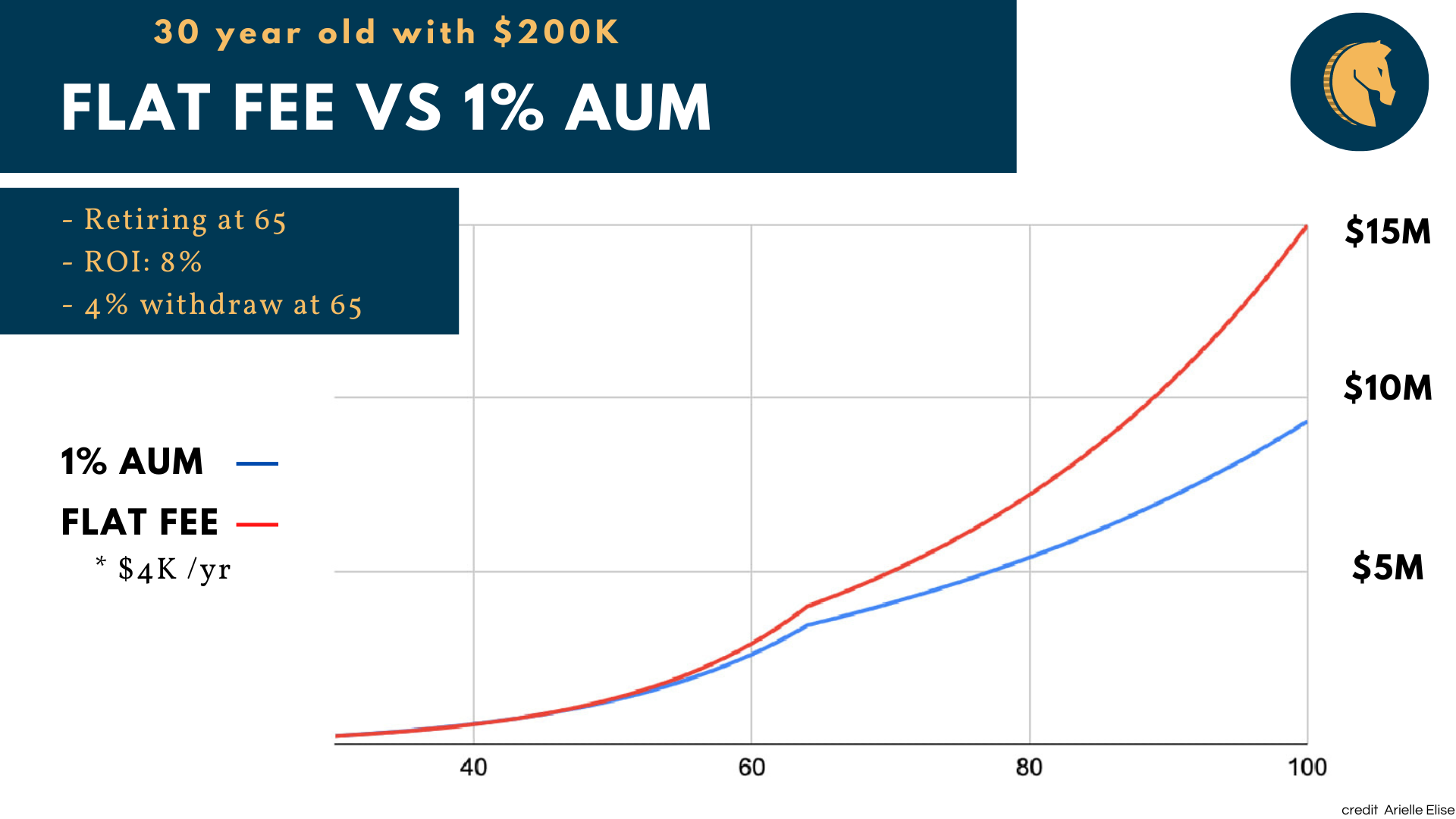

Don't Pay More as Your Portfolio Grows

Under the AUM model, a client with a $2M portfolio will pay 10X more than a client with $200k for essentially the same service. You should be the one who benefits from compounding growth, not your advisor. Over the long run, the amount you save working with a flat fee advisor is overwhelming!

AUM Model Creates Conflicts of Interest

Traditionally, most advisors charge a percentage of the assets they manage for you, referred to as Assets Under Management (AUM). This makes them biased towards advising you to put as much of your money into their managed portfolio and away from opportunities like:

- Paying off debt

- Real Estate Investments

- Employer 401(k) or 403(b)

Protecting You from Unethical Practices

It's hard to know who to trust when it comes to your finances. You could spend days searching for independent advisors while having to stay vigilant for deceptive tactics. We only work with advisors who are committed to putting their clients' interests first and enforce strict guidelines for client engagements including:

- No Net Worth Minimums

- No Commissions for Selling Products

- Discontinue Your Service at Any Time

Seamlessly Connecting You to Financial Experts

Most platforms will call you first to "see if you're a good fit" before showing you any options. At Rally, we believe everyone is fit to work with a financial advisor. We connect you directly with advisors, no middlemen, and zero hassle.

Finances are complicated, finding help shouldn't be.

Our advisor marketplace is the easiest way to find affordable and trustworthy advisors ready to help you get control of your finances and reach financial freedom

Rally is committed to flat fee. Advisors on Rally are certified and transparent about price. Our vetted advisors are ready to provide holistic guidance, and not confuse you with pricing schemes and jargon

The Value of Good Financial Advice

Read the Good Advice blog to learn about the benefits of working with a financial advisor

Why You Should Be Working With a Flat Fee Financial Advisor

When seeking a financial advisor, working with one who charges a flat fee is the better option

.png)